Nexus Secures $700M Fund to Fuel AI and India's Digital Boom

Nexus Bets Big on AI and India with New $700 Million Fund

Cross-border venture firm Nexus Venture Partners has wrapped up its eighth funding round, locking in $700 million to back two of today's hottest sectors: artificial intelligence and India's digital transformation.

Steady as She Goes

The new fund matches the size of its 2023 predecessor, reflecting Nexus's consistent strategy. "We don't raise funds just for fundraising's sake," explains Managing Partner Jishnu Bhattacharjee. The eight-member team believes this amount perfectly covers their sweet spot - early-stage investments from seed rounds through Series A, with initial checks typically around $1 million and capping at $15 million.

Where the Money's Flowing

AI: Building the Tools Behind the Tools

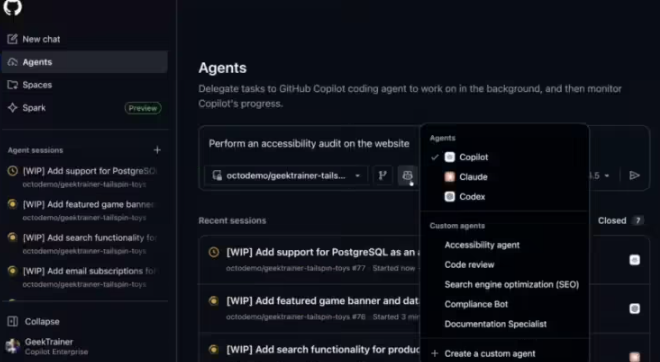

Nexus isn't chasing flashy AI applications. Instead, they're drilling down into the infrastructure layer - the picks and shovels of the AI gold rush. Their portfolio already includes developer platforms like Postman and MinIO. Now they're doubling down on monitoring tools, synthetic data solutions, and reinforcement learning frameworks.

"AI is moving from novelty to necessity," notes Managing Partner Abhishek Sharma. The firm plans three to four concentrated bets in code generation tech, customer service automation, and specialized chips for edge computing.

India: Digital Growth Meets Local Innovation

Across the Indian Ocean, Nexus sees a different kind of opportunity. Investments like instant delivery startup Zepto (using AI for logistics) and cloud provider Neysa (focusing on regional language models) showcase their thesis: India's combination of technical talent and unique market needs creates fertile ground for homegrown solutions.

"Indian entrepreneurs aren't just copying Silicon Valley anymore," a partner observes. "They're building for local realities - think voice interfaces for non-English speakers or frugal tech for price-sensitive consumers."

The Nexus Difference

What sets this 18-year-old firm apart? Their unusual cross-border approach:

- Single fund structure covering both U.S. and Indian deals

- Same rigorous due diligence for all investments

- Patient capital - typical holding periods span 7-10 years

The strategy has delivered results: $3.2 billion deployed across 130+ companies, with over 30 successful exits via IPOs or acquisitions.

What Comes Next?

The clock starts now - Nexus aims to fully deploy this fund within three years, setting the stage for their next fundraising round in early 2027. While some worry about AI overheating, the firm remains selective. "Great companies get built in all markets," Bhattacharjee reflects. "Our job is finding founders who understand that real value comes from solving hard problems, not chasing trends."

Key Points:

- $700M Fund Size: Matches previous fund; reflects disciplined approach

- Investment Split: 50% AI infrastructure/tools, 50% India digital economy

- Ticket Sizes: $1M-$15M range focuses on early-stage opportunities

- Track Record: $3.2B total AUM with 30+ exits since 2006 founding