OpenAI's Soaring Valuation Raises Eyebrows as Experts Question Financial Stability

OpenAI's Financial Tightrope Walk

The numbers are staggering - an $830 billion valuation, a $100 billion funding target, trillion-dollar deals reshaping entire industries. But beneath OpenAI's meteoric rise, financial experts are sounding alarms about the sustainability of this AI juggernaut's growth.

The 'Too Big to Fail' Debate

Harvard economist Jason Furman recently delivered a sobering assessment: "OpenAI is not too big to fail." His comments cut through the hype surrounding the company that brought ChatGPT to the world. While governments might bail out traditional banks or automakers during crises, Furman suggests no such safety net exists for tech startups - even those valued higher than most national economies.

"We're seeing classic bubble warning signs," says MIT technology economist David Autor. "When valuations outpace revenue by orders of magnitude, history tells us what usually follows."

Trillion-Dollar Gambles

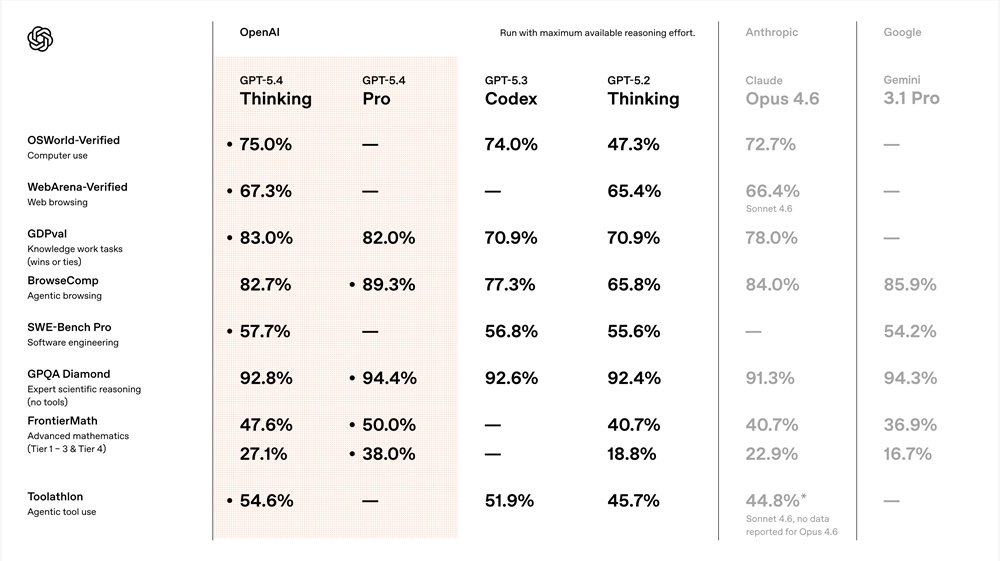

The Wall Street Journal revealed OpenAI's ambitious new funding round last week, which would nearly double its previous valuation. This comes amid massive partnerships:

- Chip manufacturers racing to meet AI processing demands

- Cloud providers expanding data center capacity

- Tech giants integrating OpenAI models into core products

Yet these deals come with strings attached. "They're essentially mortgaging future revenue streams," explains Stanford finance professor Susan Athey. "If adoption slows or competitors catch up, that debt could become crushing."

The Profitability Paradox

What keeps analysts up at night? OpenAI still isn't profitable despite its astronomical valuation. The company burns through cash developing increasingly complex models while giving away many services for free.

"It's the WeWork scenario on steroids," warns NYU finance professor Aswath Damodaran. "Except instead of office space, they're betting everything on artificial general intelligence materializing exactly as predicted."

The counterargument comes from venture capitalists like Marc Andreessen: "In transformative tech waves, traditional metrics don't apply. Google wasn't profitable initially either."

Key Points:

- Valuation surge: From $500B to $830B in months

- Funding target: Seeking $100B in new investment

- Expert skepticism: Harvard economist disputes 'too big to fail' status

- Profit concerns: Massive deals offset by ongoing losses

- Market implications: Potential ripple effects across tech sector