Google Rolls Out AI-Powered Fraud Protection Features for Indian Users

Google Strengthens India's Digital Defenses with New Anti-Fraud Features

In response to India's escalating digital fraud crisis, Google unveiled two groundbreaking security measures on November 20, 2025. These innovations leverage artificial intelligence to protect users from increasingly sophisticated scams.

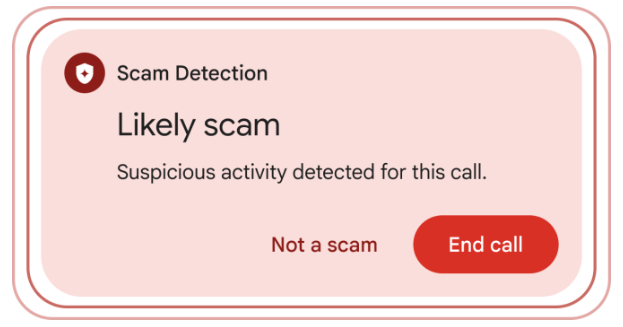

Real-Time Protection Against Fraud Calls

The Gemini Nano-powered call detection system represents a significant leap forward in mobile security. Exclusively available on Pixel 9 and newer models, this feature analyzes voice characteristics of unknown callers directly on your device - no cloud processing required. "We designed it to work entirely locally," explains Google's product team, "so conversations stay private while still getting protection."

Financial Safety Nets During Screen Sharing

Partnering with major Indian fintech players like Navi, Paytm and Google Pay, the second feature tackles a growing scam tactic. When Android 11+ users access financial apps during screen-shared calls, the system displays an urgent warning banner with quick-action buttons. "One tap simultaneously ends the call and stops sharing," notes the security lead behind the project.

The Rising Tide of Digital Fraud

The timing couldn't be more critical. Official reports reveal:

- 13,516 digital fraud cases recorded in 2024 (₹5.2 billion losses)

- First five months of 2025 saw losses spike to ₹70 billion

- Google Play Protect blocked 115 million risky app installations this year

- Google Pay issues over 1 million suspicious transaction warnings weekly

"These aren't just statistics," emphasizes a Google spokesperson. "Each number represents someone's hard-earned money potentially saved."

Implementation Details Users Should Know

The fraud detection operates discreetly - disabled by default with only an alert sound when triggered. Currently supporting English interfaces, Hindi and other regional language options are coming soon alongside expanded banking app coverage.

Behind the scenes, Google continues collaborating with India's central bank to verify legitimate lending apps through its DigiKavach initiative (already reaching 250 million Indians). The company also plans releasing SynthID watermark detection tools to help developers identify AI-generated fake content.

Key Points:

- Pixel-exclusive AI analyzes scam calls locally without cloud uploads

- Screen sharing alerts activate during financial app use on supported Androids

- Default-off setting prioritizes user control over automatic scanning

- English support first, with Indian languages coming soon

- Part of broader ₹70 billion fraud prevention effort

- Future plans include watermark detection for AI content