Ant Tech and Tongfang Global Partner to Revolutionize Insurance with AI

AI Transforms Insurance Claims Processing

In a move that could reshape how insurance claims are handled, Ant Technology and Tongfang Global Life Insurance announced a groundbreaking partnership on January 22. The collaboration centers on applying artificial intelligence across insurance operations, with immediate focus on revolutionizing the claims process.

Breaking Through Traditional Bottlenecks

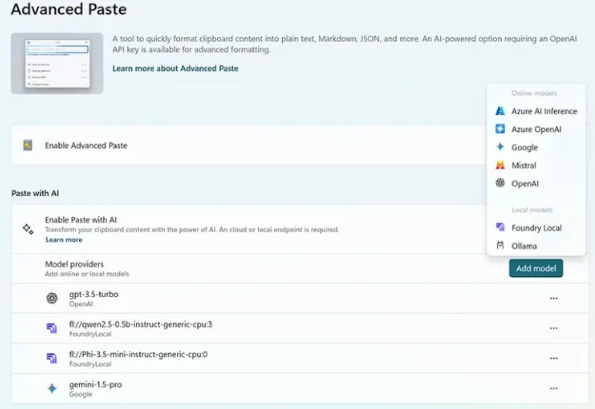

The insurance industry has long struggled with manual claims review processes that consume time and resources. "We're tackling the pain points head-on," explains Sun Lei, Ant Technology's Vice President. Their new intelligent claims system leverages cutting-edge AI agents and multimodal large model technology to:

- Detect document fraud with 99% accuracy

- Automatically classify and quality-check submissions

- Analyze context and flag missing information

- Review policy coverage automatically

Caption: Sun Lei (left) and Zhu Qingguo formalize the AI insurance partnership

Caption: Sun Lei (left) and Zhu Qingguo formalize the AI insurance partnership

Real-World Results Speak Volumes

Early testing shows remarkable improvements:

"Simple cases that used to take days now complete in under an hour," notes Zhu Qingguo, Tongfang Global's General Manager. "We're seeing nearly double the overall efficiency."

The system's success earned recognition as a "Golden Dragon·Financial Power" annual case by Financial Times - a testament to its impact on both customer experience and risk management.

Beyond Claims: A Broader Vision

While claims processing marks their starting point, both companies envision broader applications:

- Underwriting: Faster, more accurate risk assessment

- Marketing: Personalized product recommendations

- Customer Service: 24/7 intelligent assistance

- Risk Control: Real-time fraud detection

"This is just the beginning," Sun Lei adds. "We're building an industry benchmark for AI transformation."

The partnership combines Ant Tech's financial AI expertise with Tongfang's deep insurance knowledge - potentially setting a new standard for tech-driven insurance solutions.