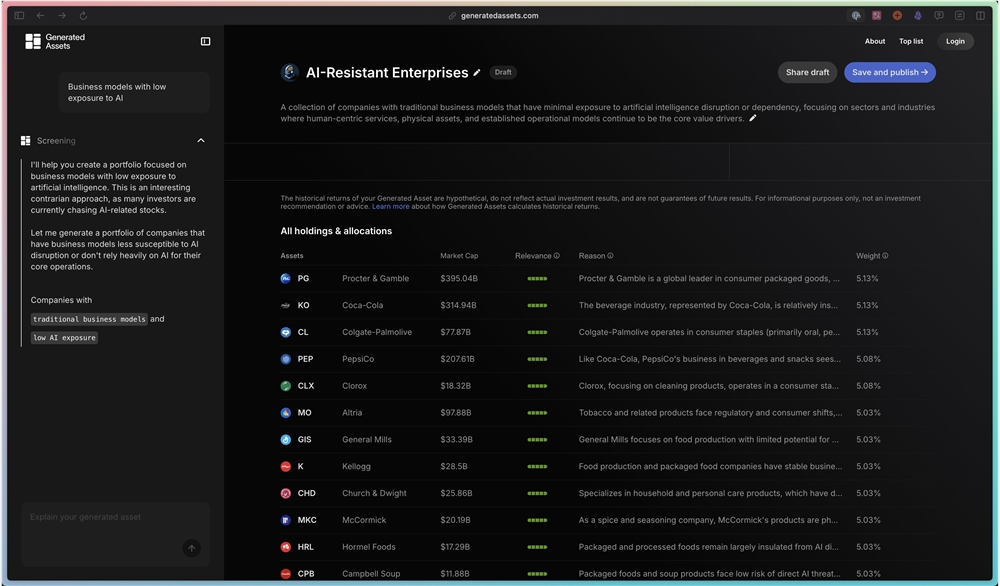

Public Launches AI-Powered Investment Index Generator

Investment platform Public has unveiled its groundbreaking AI feature, Generated Assets, enabling users to create custom investment indices simply by describing their ideas in plain text. This innovation transforms complex market analysis into a seamless "input-generate-track" process, potentially democratizing access to sophisticated investment strategies.

How Generated Assets Works

The system leverages an AI-driven index generation engine that interprets natural language inputs like "invest in AI-driven medical technology" or "focus on sustainable energy." Developed in collaboration with IndexGPT, the technology analyzes market data, financial reports, and industry trends to assemble relevant stock portfolios within seconds.

Users receive not just a custom index but also valuable context:

- Real-time performance tracking

- Historical comparisons against major indices (S&P 500, Nasdaq-100)

- Dynamic adjustment capabilities

During testing, AIbase confirmed the system generates portfolios of 10-15 stocks in approximately 30 seconds, with historical accuracy rates reaching 90%.

Technical Breakthroughs

The platform's success stems from several advanced features:

Natural Language Processing interprets vague concepts like "metaverse-related companies," accurately identifying stocks such as Meta Platforms and Roblox.

Massive Data Integration processes over 100 trillion words of financial data to generate reliable performance projections.

Accessibility Design requires no financial expertise—users can start investing with as little as $0.01 per share through an intuitive interface.

Practical Applications

From novice investors to seasoned professionals, Generated Assets serves diverse needs:

- Beginners can instantly create portfolios around familiar concepts like "green energy" or "tech giants"

- Thematic investors explore niche interests from esports to quantum computing

- Analysts validate strategies by comparing custom indices against market benchmarks

- Active traders respond quickly to market shifts during earnings seasons or news events

The tool particularly resonates with younger investors—its social media-friendly "mood investing" approach has already attracted over 3 million active users to Public's platform.

Market Impact and Reception

The financial community has hailed Generated Assets as the "ChatGPT of retail investing" for merging generative AI with practical investment tools. While praised for its simplicity—some users report making their first investments within five minutes—questions remain about transparency in stock selection algorithms.

Public addresses these concerns by promising more detailed explanations of its weighting methodologies in future updates. The launch intensifies competition with existing AI investment tools like Magnifi and Danelfin while challenging traditional ETFs through greater customization and lower costs.

The innovation may inspire similar developments in global markets, particularly in China where platforms like Snowball could adapt the technology using domestic AI models. However, experts caution that users should balance AI-generated insights with traditional risk assessment methods.

The Future of AI-Driven Investing

Public's Generated Assets represents a significant leap toward intelligent, accessible investment tools. By bridging the gap between conceptual thinking and portfolio construction, it empowers a new generation of investors while raising important questions about algorithmic transparency and risk management in an increasingly automated financial landscape.

For those exploring this new frontier, remember: while AI simplifies analysis, sound investing still requires understanding your risk tolerance and monitoring market conditions. Watch for Public's upcoming disclosures about their selection algorithms to make fully informed decisions.

Key Points

- Public's Generated Assets creates custom investment indices from natural language descriptions

- The AI tool delivers portfolios in 30 seconds with 90% historical accuracy

- Features include real-time tracking and benchmark comparisons against major indices

- Appeals particularly to younger investors through "mood investing" approach

- Raises important questions about algorithmic transparency in fintech