ChatGPT Shakes Up Auto Insurance With Smart Comparison Tool

ChatGPT's New Tool Turns Insurance Shopping Into Simple Conversation

The days of confusing insurance forms and hard-to-compare quotes may be numbered. On February 9, 2026, ChatGPT introduced a game-changing feature that lets users find personalized car insurance rates through natural conversation.

What Makes This Different?

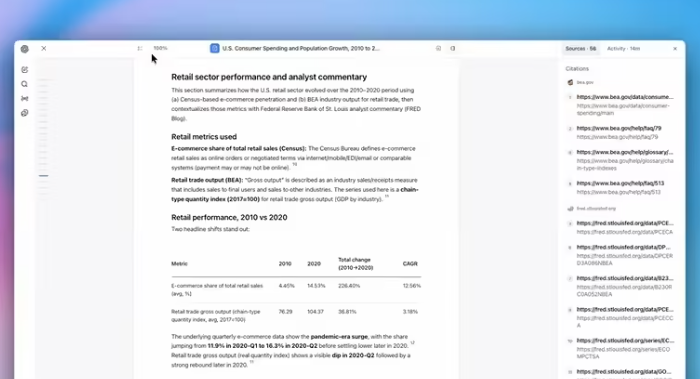

Instead of filling out endless forms, you simply tell ChatGPT about your car, driving history, and location. Within seconds, it analyzes 196 million existing quotes from Insurify's database to show your best options.

"It's like having an expert broker in your pocket," explains tech analyst Mark Chen. "But one that works instantly and doesn't earn commissions."

The impact was immediate. Insurance stocks tumbled, with industry leader Willis Towers Watson dropping 12% in a single day - its worst performance in years.

Why Brokers Are Worried

Traditional brokers have long benefited from the complexity of insurance shopping. Their expertise came at a price - both in fees and potentially biased recommendations.

This new tool changes that dynamic completely:

- Transparent pricing: See how different factors affect your rate

- Side-by-side comparisons: Easily weigh costs against coverage details

- Real customer reviews: Access over 70,000 verified experiences

The system even explains insurance jargon in plain language when you ask.

Efficiency Boost or Industry Killer?

Insurify CEO Snejina Zacharia sees this as evolution, not revolution: "We're making something stressful surprisingly pleasant."

But Wall Street isn't convinced. The dramatic stock reactions suggest investors fear this could be the first step toward cutting out human intermediaries entirely.

The big question now: Will other insurers adapt or fight back? With AI tools becoming increasingly sophisticated, the entire insurance landscape might look very different in just a few years.

Key Points:

- ChatGPT now offers instant car insurance comparisons through conversation

- Uses 196 million data points to generate personalized quotes

- Insurance stocks dropped sharply after announcement

- Could fundamentally change how consumers shop for coverage

- Part of broader trend toward AI-powered financial services