OpenAI Targets Late 2026 IPO with Potential Trillion-Dollar Valuation

OpenAI Prepares for Historic 2026 IPO

Artificial intelligence pioneer OpenAI is laying groundwork for what could become one of the most significant tech IPOs of the decade. According to Reuters sources, the company plans to go public in late 2026, with early valuations suggesting potential worth in the tens of billions.

Strategic Preparations Underway

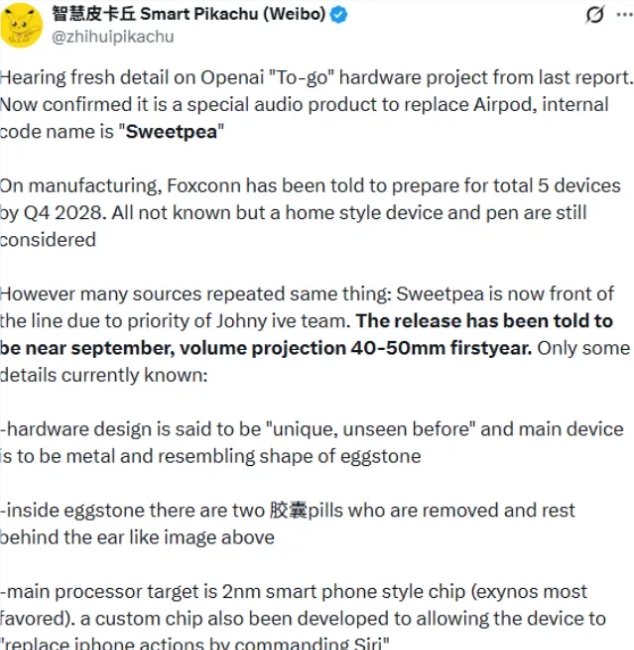

The San Francisco-based company has recently completed a profit model restructuring, creating financial foundations suitable for public markets. Simultaneously, OpenAI solidified its partnership with Microsoft, focusing on hardware development and advancing general artificial intelligence (AGI) research. This collaboration provides OpenAI with critical infrastructure support while maintaining its technological edge.

Market Position and Growth Trajectory

Since launching ChatGPT in late 2022, OpenAI has emerged as a dominant force in generative AI:

- Maintains industry-leading language models

- Boasts extensive enterprise adoption

- Continues rapid product innovation cycles

The company's revenue streams have diversified significantly, combining:

- Enterprise API services

- Premium consumer products

- Strategic partnership revenues

- Emerging hardware collaborations

Economic Context and Investor Interest

The planned IPO arrives during a period of renewed investor confidence in transformative technologies. As tech stocks rebound from recent market corrections, analysts view OpenAI's listing as:

- A bellwether for AI sector maturity

- A potential catalyst for broader tech investment

- An opportunity for public market participation in AGI development

The company emphasizes it will maintain transparent disclosure practices throughout the IPO process to build investor trust.

Key Points:

- 🚀 Planned late 2026 IPO could value OpenAI at tens of billions

- 💼 Recent profit model restructuring positions company for public markets

- 🤝 Strengthened Microsoft partnership provides strategic advantages

- 📊 Listing seen as indicator of tech sector recovery

- 🔍 Company pledges full transparency during offering process