China's Cloud AI Pioneer Sunlu Tech Goes Public Amid Computing Power Race

China's Cloud Computing Power Gets Major Boost

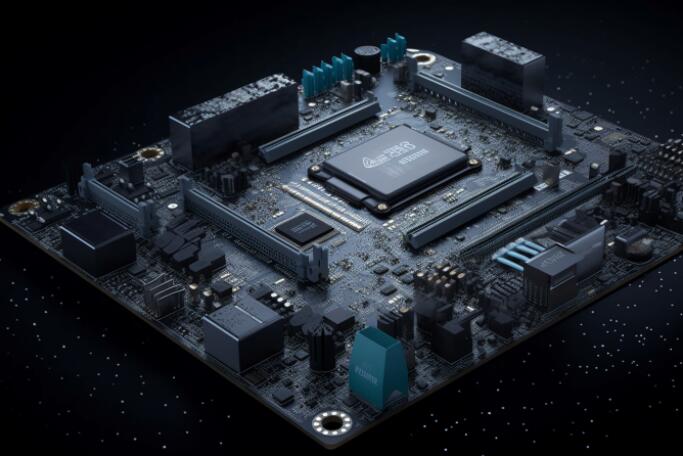

In a significant development for China's tech sector, Shanghai Sunlu Technology has taken its first formal step toward becoming a publicly traded company. The cloud AI chip specialist submitted its IPO application to the Shanghai Stock Exchange on January 22, 2026.

From Startup to Semiconductor Contender

The company's journey reads like classic tech startup lore. Founded in 2018 by former semiconductor engineers, Sunlu has quietly developed four generations of cloud-optimized AI processors while building an impressive patent portfolio.

"What makes Sunlu interesting," notes industry analyst Zhang Wei, "is their vertical integration approach. They're not just designing chips - they've built the entire software stack to optimize them for cloud workloads."

The Billion-Yuan Bet on Domestic Tech

The planned 6 billion yuan ($840 million) offering comes as China accelerates efforts to reduce reliance on foreign semiconductor technology. Government initiatives have poured billions into domestic chip development following U.S. export restrictions.

Sunlu's proprietary architecture reportedly delivers comparable performance to leading international alternatives while consuming less power - a critical advantage for data center operators facing soaring electricity costs.

Inside Sunlu's Tech Stack

The company's flagship "DeepCloud" platform combines:

- Custom-designed tensor processing units (TPUs)

- Specialized memory architecture

- Proprietary compiler technology

The system currently powers AI services for several major Chinese internet companies and financial institutions.

Challenges Ahead

The road ahead isn't without obstacles:

- Intensifying competition from established players

- Ongoing global chip shortages affecting production

- Geopolitical tensions impacting supply chains

- Rising R&D costs in cutting-edge semiconductor design

- Talent wars with better-funded rivals

Despite these hurdles, early investor reactions appear positive given strong government backing and growing enterprise demand for domestic alternatives.

Key Points:

- IPO Filing: Submitted January 2026 for STAR Market listing

- Funding Target: 6 billion yuan ($840 million)

- Core Technology: Vertical stack combining custom chips and software

- Market Position: Emerging leader in China's domestic AI chip sector

- Competitive Edge: Power efficiency and government support