Public Launches AI-Powered 'Generated Assets' for Instant Investment Index Creation

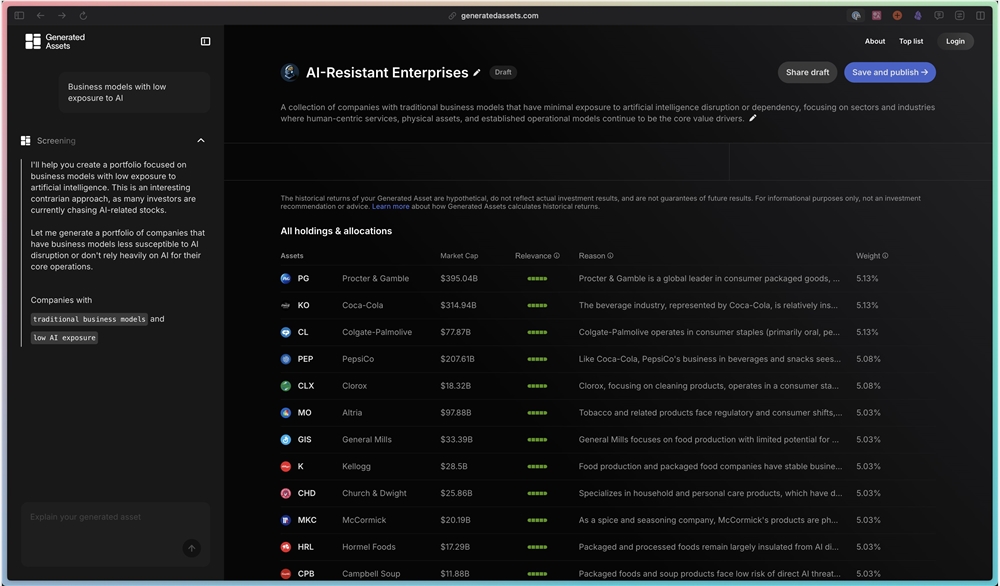

Investment platform Public has unveiled Generated Assets, a groundbreaking AI-powered feature that transforms natural language descriptions into fully functional investment indices. With this innovation, users can now type phrases like "AI-driven medical technology" or "sustainable energy stocks" and instantly receive a curated portfolio matching their vision.

How Generated Assets Works

The system leverages Public's partnership with IndexGPT, utilizing large language models to analyze market data, financial reports, and industry trends. When a user inputs an investment concept, the AI scans thousands of data points to identify relevant stocks and constructs a balanced index. Testing shows the process takes just 30 seconds to generate portfolios containing 10-15 stocks.

What sets this apart is its real-time functionality. Investors can track performance against benchmarks like the S&P 500 while monitoring price fluctuations through Public's trading platform. The feature supports fractional shares, allowing entry positions as small as $0.01.

Technical Innovation Behind the Scenes

Public's engineers have built what they call a "multimodal AI analysis engine" with several key capabilities:

- Natural Language Processing: Understands vague concepts like "metaverse-related companies" and identifies appropriate stocks such as Meta Platforms or Roblox

- Historical Simulation: Draws from 100 trillion data points to project how the generated index would have performed historically with 90% accuracy

- Dynamic Adjustment: Continuously updates portfolio weights based on market conditions and corporate developments

The platform effectively bridges the gap between casual investors and complex financial instruments. As one beta tester noted: "It feels like having a Wall Street quant team in your pocket."

Who Benefits Most?

Three distinct groups stand to gain from this innovation:

- First-time investors can bypass the steep learning curve of traditional analysis

- Thematic investors exploring niche sectors like esports or clean technology get tailored exposure

- Seasoned traders use the historical comparison tools to backtest strategies quickly

The timing couldn't be better. With younger generations embracing so-called "mood investing" - making decisions based on personal interests rather than cold metrics - Generated Assets provides structure to this emerging trend.

Market Reaction and Future Implications

Early adopters have flooded social media with praise, dubbing it the "ChatGPT of retail investing." Public's active user base has already surpassed 3 million since the launch, though some critics question the transparency of the AI's selection methodology.

The development signals a broader shift in financial services. Traditional ETFs now face competition from these dynamic, personalized indices while robo-advisors must adapt to remain relevant. Industry observers predict Chinese platforms may soon introduce similar tools using domestic AI models like Qwen3.

Key Points

- Public's Generated Assets creates custom investment indices from plain text descriptions in under 30 seconds

- The AI analyzes market data, financial reports, and trends to build personalized portfolios

- Users gain real-time tracking and historical performance comparisons against major indices

- The tool particularly benefits novice investors and those pursuing thematic strategies

- Industry analysts see this as part of a broader democratization of sophisticated investment tools