Intel-Backed AI Startup Articul8 Hits $500M Valuation With Focus on Regulated Industries

The Quiet Rise of Enterprise AI

While ChatGPT grabs headlines, Articul8 has been solving a less glamorous but lucrative problem: bringing artificial intelligence to industries where mistakes could mean regulatory fines or safety disasters. The Intel-incubated company recently closed the first half of its $70 million Series B round at a staggering $500 million valuation - five times its worth just two years prior.

Banking on Boring (But Critical) AI

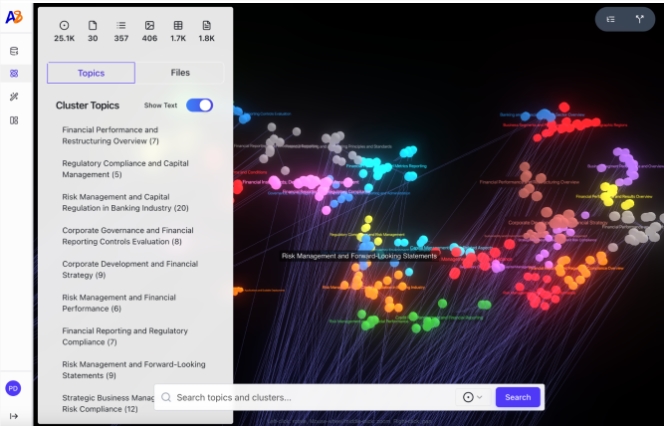

CEO Arun Subramaniyan isn't chasing the generative AI hype. Instead, Articul8 builds what he calls "auditable intelligence" - specialized systems that run entirely within a company's own servers. These aren't chatbots trying to write poetry, but precision tools analyzing factory sensor data or flagging suspicious financial transactions.

"When an energy company needs to predict equipment failures or a bank must explain every loan decision to regulators," Subramaniyan explains, "they can't afford black-box algorithms running on some cloud server."

The approach resonates with cautious industries. Articul8 already counts 29 paying clients including AWS (both customer and partner), Hitachi Energy and investment giant Franklin Templeton. Their contracts total over $90 million - serious revenue for a 75-person team.

Global Growth Plans

The fresh funding will fuel expansion into Europe and Asia, where strict privacy laws create ripe markets for Articul8's localized AI solutions. Spanish VC firm Adara Ventures led the round, providing crucial connections to European industrial giants.

Interestingly, while born from Intel, Articul8 maintains partnerships across tech rivals - working with NVIDIA chips while also collaborating with Google Cloud. It's a pragmatic approach reflecting enterprise realities: big companies want best-of-breed solutions, not vendor lock-in.

The Future Is Specialized?

As investors grow wary of generic AI platforms burning cash, Articul8's success suggests another path forward. "We're seeing CIOs move from 'Can we build with AI?' to 'Should we?'" notes Subramaniyan. In regulated sectors especially, accuracy and accountability trump raw technological prowess.

The company expects to hit $57 million in recurring revenue by 2026 - nearly half already confirmed through existing contracts. Not bad for avoiding the generative AI gold rush.

Key Points:

- Valuation jump: From $100M (2024) to $500M pre-money valuation

- Revenue model: Already profitable with $90M+ in customer contracts

- Specialization: Focused on finance, manufacturing and energy sectors

- Tech approach: Fully auditable AI systems running on-premise

- Global reach: Expanding in Europe/Asia with strategic investors