Figma Targets $20B NYSE IPO, Betting on AI Design

Figma Files for NYSE IPO With $20 Billion Valuation Target

San Francisco-based design collaboration platform Figma has officially submitted its IPO application to the SEC, planning to list on the New York Stock Exchange under the ticker FIG. The company is targeting a $20 billion valuation, positioning itself as one of the most anticipated tech IPOs of 2025.

From Startup to Design Powerhouse

Founded in 2012 by Dylan Field and Evan Wallace, Figma revolutionized design software with its browser-based, real-time collaboration platform. Unlike traditional tools like Adobe XD or Sketch, Figma enables designers, developers, and product managers to work simultaneously on projects.

Key metrics demonstrate Figma's market dominance:

- 13 million monthly active users (as of March 2025)

- Two-thirds of users come from non-traditional design roles

- Expanding product suite including FigJam whiteboards and Dev Mode

The company recently introduced Figma Sites in beta - allowing direct publishing of designs as functional websites - and has made significant investments in AI capabilities.

Financial Performance Supports High Valuation

Figma's S-1 filing reveals strong financial fundamentals:

- 2024 Revenue: $749M (48% YoY growth)

- Q1 2025 Revenue: $228.2M (46% YoY growth)

- Net Income: $44.9M in Q1 (3x YoY increase)

- Customer Base: Over 1,000 clients contributing >$100K annually

The company maintains:

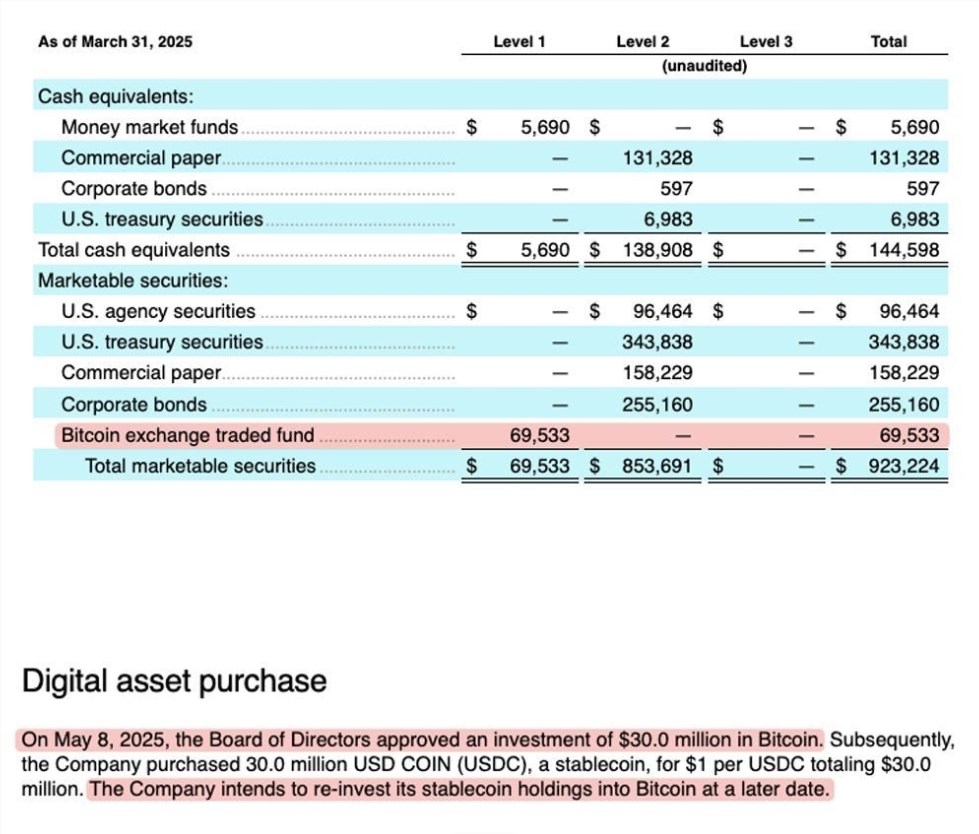

- 91% gross margins

- 150% net dollar retention rate

- $1.54B cash reserves with no debt

Notably, Figma has allocated $69.5M to Bitcoin spot ETFs with plans for additional $30M investments.

From Failed Acquisition to Independent Future

The IPO follows Adobe's abandoned $20B acquisition attempt in 2023 due to EU/UK antitrust concerns. The failed deal resulted in a $1B breakup fee that bolstered Figma's balance sheet.

Secondary market valuations have climbed steadily:

- May 2024: $12.5B

- April 2025: $17.84B

The current $20B target matches Adobe's original offer but reflects confidence in Figma's standalone growth potential.

Competitive Landscape and AI Strategy

While commanding 90% market share in design tools, Figma faces competition from:

- Adobe XD and Sketch (traditional rivals)

- Canva (simplified design)

- AI-powered newcomers like Lovable The company acknowledges in its filing that continuous AI investment is critical to maintaining leadership.

Recent strategic moves include:

- Acquisitions of Payload and Modyfi (2024)

- Google for Education partnership

FedRAMP Moderate certification for government contracts

Future Growth Plans

CEO Dylan Field outlined three key focus areas:

- Global expansion (currently >50% revenue from outside U.S.)

- Enterprise customer acquisition through advanced features

- AI innovation including generative design capabilities

The company plans to raise approximately $1.5B in the IPO, which could rank among 2025's largest tech offerings.

Key Points:

- Figma files for NYSE IPO targeting $20B valuation

- Strong financials: 48% revenue growth, improving profitability

- Failed Adobe deal provided $1B breakup fee

- AI mentioned over 200 times in S-1 filing – Expanding beyond design into full product development platform