Figma Targets $20B NYSE IPO Amid AI Design Boom

Figma Files for NYSE IPO with $20 Billion Valuation

San Francisco-based design software company Figma has officially submitted its IPO application to the SEC, planning to list on the New York Stock Exchange under the ticker FIG. The company targets a $20 billion valuation, positioning it as one of 2025's most anticipated tech debuts.

From Startup to Design Powerhouse

Founded in 2012 by Dylan Field and Evan Wallace, Figma revolutionized design workflows with its browser-based, real-time collaboration platform. Unlike traditional tools like Adobe XD, Figma enables seamless teamwork among designers, developers, and product managers. The platform now boasts 13 million monthly active users, with two-thirds coming from non-traditional design roles.

Expanding Product Ecosystem:

- Figma Design: Core UI/UX design tool

- FigJam: Digital whiteboard for team collaboration

- Dev Mode: Developer-focused code conversion tool

- Figma Sites: Beta website publishing platform (2025 launch)

The company's S-1 filing mentions AI over 200 times, highlighting features like Figma Make (AI-generated prototypes) and plans for deeper generative AI integration.

Financial Performance Supports Valuation

Figma's financials demonstrate remarkable growth:

- 2024 Revenue: $749M (+48% YoY)

- Q1 2025 Revenue: $228.2M (+46% YoY)

- Net Income: $44.9M (3x YoY growth)

- Customer Base: 1,031 clients spending >$10M annually

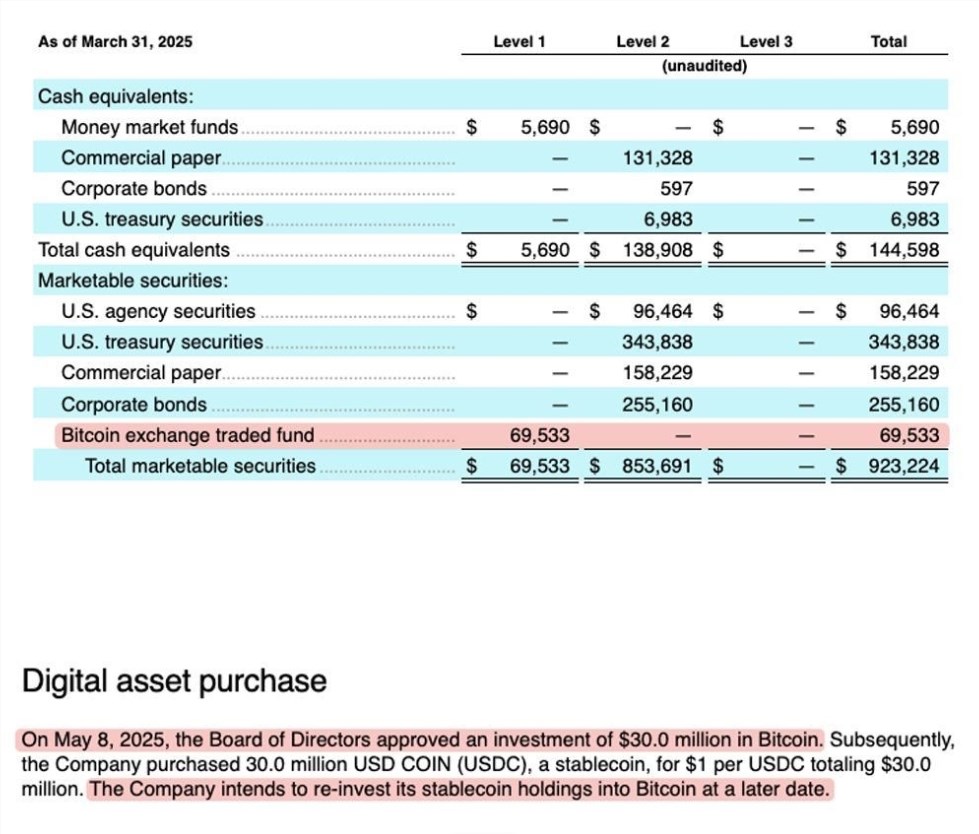

The company maintains a 91% gross margin and holds $1.54B in cash reserves, including $69.5M in Bitcoin ETFs.

From Failed Acquisition to Independent Future

Adobe's attempted $20B acquisition collapsed in 2023 due to antitrust concerns, netting Figma a $1B breakup fee. Since then:

- Secondary market valuation grew from $12.5B (2024) to $17.84B (2025)

- Current IPO targets matching Adobe's original offer price

The offering could raise $1.5 billion, capitalizing on strong investor appetite following successful 2025 tech IPOs like CoreWeave (+290%).

Competitive Landscape and AI Strategy

While commanding 90% market share, Figma faces competition from:

- Traditional rivals: Adobe XD, Sketch, Canva

- AI-native tools: Lovable and others The company has acquired AI startups (Payload, Modyfi) and secured FedRAMP certification for government contracts.

Growth Roadmap: Global Expansion and Enterprise Focus

Key strategic priorities include:

- International growth (currently >50% non-US revenue)

- Enterprise customer acquisition through advanced features

- Continued AI investment for workflow optimization CEO Dylan Field emphasized: "We will continue taking bold steps through acquisitions" - signaling ambitions beyond design tools.

Key Points:

- Figma files for NYSE IPO at $20B valuation (Ticker: FIG)

- 13M monthly users with expanding non-designer adoption

- Strong financials: $749M revenue (2024), 91% gross margin

- Failed Adobe deal provided $1B breakup fee and independence

- AI integration central to future competitiveness