Figma Targets $20B NYSE IPO, AI Design in Focus

Figma Files for NYSE IPO with $20 Billion Valuation

San Francisco-based design software company Figma has officially submitted its IPO application to the SEC, planning to list on the New York Stock Exchange under the ticker FIG. With a target valuation of $20 billion, this marks one of the most anticipated tech IPOs of 2025.

From Design Tool to Development Ecosystem

Founded in 2012 by Dylan Field and Evan Wallace, Figma began as a browser-based interface design tool emphasizing real-time collaboration. It has since evolved into a comprehensive platform serving 13 million monthly active users, including designers, developers, and product managers.

Key products include:

- Figma Design: Core UI/UX design tool

- FigJam: Digital whiteboard for team collaboration

- Dev Mode: Developer-focused code conversion tool

- Figma Sites: Beta website publishing platform (2025 launch)

The company's S-1 filing mentions AI over 200 times, highlighting features like Figma Make (AI-generated prototypes) and plans for deeper generative AI integration.

Strong Financial Performance

Figma's financials support its high valuation:

- 2024 Revenue: $749M (+48% YoY)

- Q1 2025 Revenue: $228.2M (+46% YoY)

- Profitability: $44.9M net income in Q1 2025 (3x YoY growth)

- Customer Base: 1,031 clients generating >$10M annually

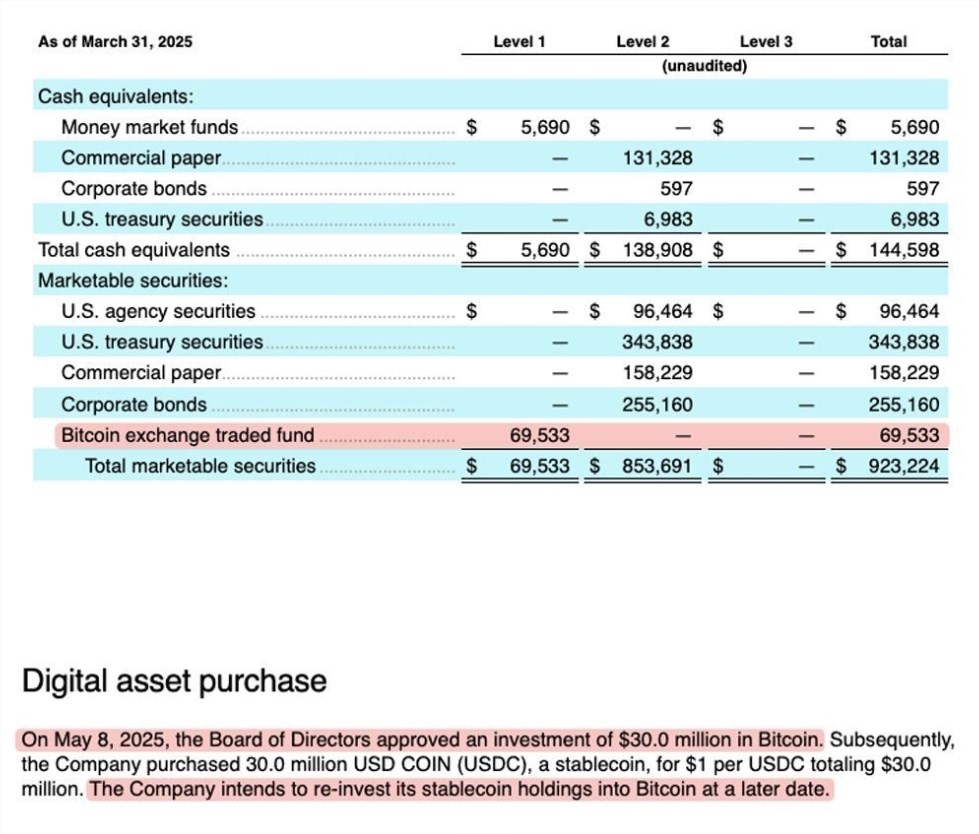

The company holds $1.54B in cash with no debt, including investments in Bitcoin ETFs. Despite a 2024 net loss due to stock compensation expenses, Figma demonstrates financial stability with 91% gross margins and 150% net dollar retention.

From Failed Adobe Deal to Independent Future

After Adobe's proposed $20B acquisition collapsed in 2023 due to antitrust concerns (yielding Figma a $1B breakup fee), the company's secondary market valuation grew from $12.5B (2024) to $17.84B (April 2025). The IPO targets the original Adobe offer price, reflecting market confidence.

The offering comes during strong investor appetite for tech stocks, following successful AI infrastructure IPOs like CoreWeave (+290%) and Circle (+519%). Figma plans to raise approximately $1.5B in the listing.

Competitive Landscape and AI Strategy

While dominating 90% of the design tool market through its PLG model, Figma faces competition from:

- Adobe XD and Sketch (traditional rivals)

- Canva (simplified design)

- AI-native tools like Lovable The company is countering through:

- Acquisitions (Payload, Modyfi - 2024)

- Google Education partnerships

- FedRAMP Moderate certification for government contracts Its S-1 emphasizes continued AI investment as critical for maintaining leadership.

Growth Priorities

Figma's roadmap focuses on:

- Global expansion (50%+ revenue already international)

- Enterprise customers via advanced analytics/security features

- AI innovation to streamline design workflows CEO Dylan Field stated: "We will continue taking bold steps, including acquisitions to expand our influence."

The IPO represents Figma's ambition to transition from design tool to end-to-end product development platform.

Key Points:

- Figma files for NYSE IPO at $20B valuation - Strong financials: $749M revenue (2024), profitable since Q1 2024 - AI integration central to strategy with 200+ mentions in S-1 - Plans $1.5B raise amid favorable tech IPO market conditions - Targets enterprise clients and global markets for future growth