Baidu's AI Chip Arm Kunlun Takes Leap Toward Hong Kong IPO

Baidu's Chip Unit Charges Toward Hong Kong IPO

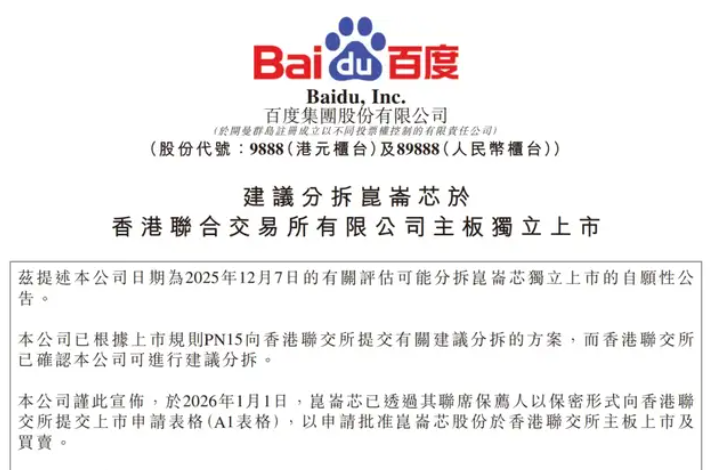

In a move that sent Baidu's shares climbing, the tech giant's semiconductor subsidiary Kunlun Xing Technology has officially filed for listing on the Hong Kong Stock Exchange. The announcement comes as China's AI chip sector shows no signs of slowing down.

From Internal Project to Industry Contender

The story of Kunlun Xing reads like a Silicon Valley startup tale - albeit with Beijing characteristics. What began in 2011 as Baidu's internal FPGA accelerator project aimed at cutting costs has evolved into China's second-largest AI chip shipper by volume. The company took its first major leap in 2018 with the debut of "Kunlun 1," built on Baidu's proprietary XPU architecture.

"This isn't just about financial engineering," observes tech analyst Li Wei. "Baidu's spinning out Kunlun at precisely the moment when global investors are hungry for pure-play AI hardware stories."

Strategic Play With Multiple Payoffs

The listing serves dual purposes for Baidu:

- Valuation clarity: Allowing markets to price Kunlun separately from its parent company

- Funding flexibility: Creating direct access to capital markets for R&D and expansion

Notably, the offering won't include preferential rights for existing Baidu shareholders - a structure that suggests confidence in broader investor appetite.

Management Incentives Align With Growth

Insiders highlight another critical benefit: the IPO ties Kunlun leadership compensation directly to performance metrics. "When you're competing against NVIDIA and other giants, you need every motivational edge," comments semiconductor consultant Zhang Tao.

The timing appears strategic. With global demand for high-performance computing chips surging across industries from cloud computing to autonomous vehicles, Kunlun aims to position itself as China's answer to specialized AI processors.

Key Points:

- Market position: Second-largest AI chip shipper in China since 2021 independence

- Technical heritage: Roots trace back to Baidu's 2011 FPGA accelerator program

- Strategic rationale: Separate valuation, direct funding access, management incentives

- Industry context: Comes amid booming global demand for specialized AI processors