Anysphere Hits $9.9B Valuation After $900M Funding Round

Anysphere, the tech startup behind the popular AI programming assistant Cursor, has achieved a staggering $9.9 billion valuation following a successful $900 million funding round. This marks the company's third major financing event within just twelve months, underscoring its rapid growth in the competitive AI sector.

The three-year-old company now boasts annualized recurring revenue (ARR) exceeding $500 million - a remarkable 60% jump from its $300 million ARR reported in April. Industry analysts note Anysphere's revenue approximately doubles every two months, a growth trajectory that has attracted heavyweight investors. Thrive Capital led this latest funding round, with participation from Andreessen Horowitz, Accel, and DST Global.

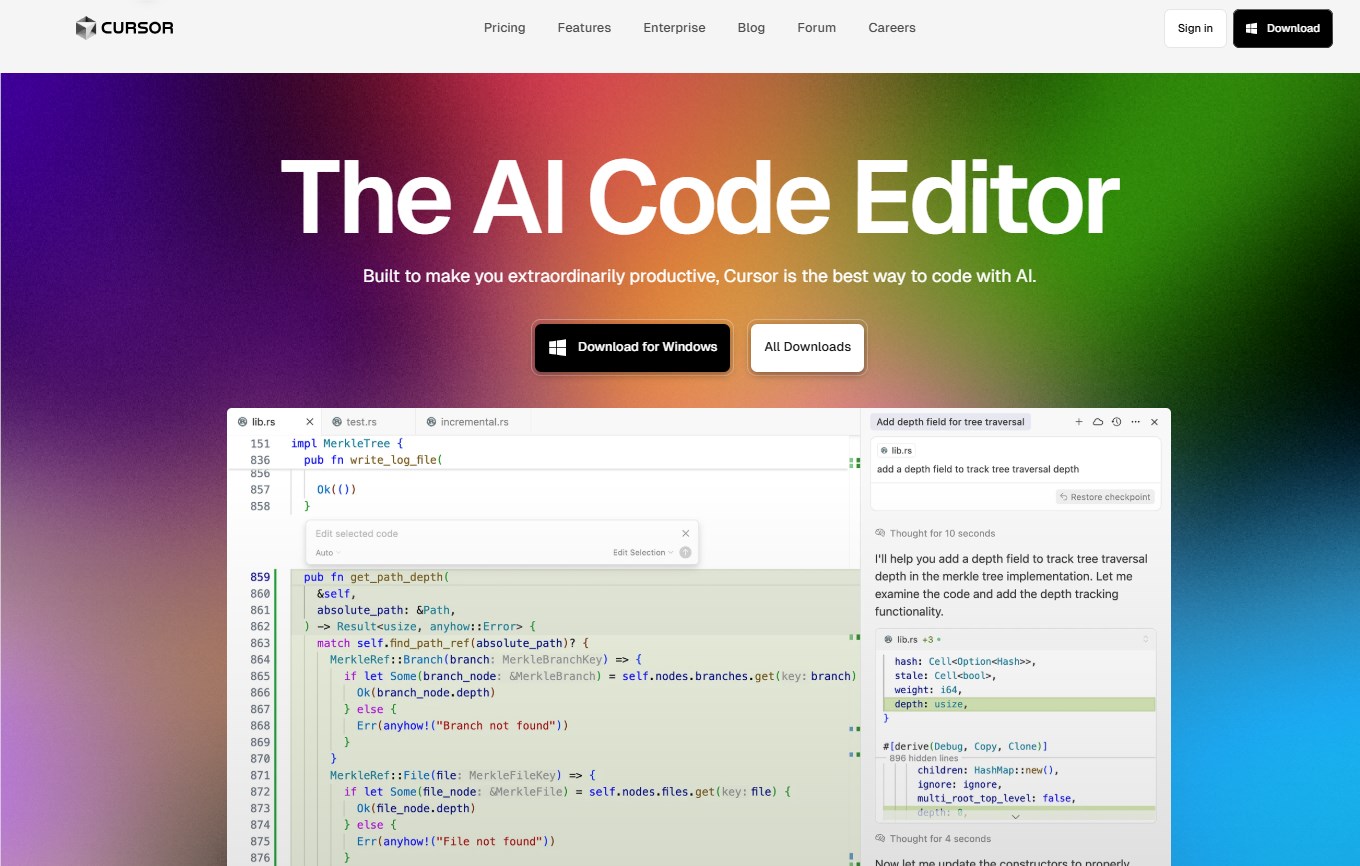

Cursor, often dubbed the "atmosphere coder" by users, has emerged as a leader in the crowded field of AI programming assistants. The platform offers tiered subscription options: a Professional Plan at $20/month and a Business Plan at $40/month, both preceded by a two-week free trial period.

While initial revenue came primarily from individual subscriptions, Anysphere has strategically expanded into enterprise solutions. The company now offers team licenses at premium pricing, creating new revenue streams while expanding market reach. This shift comes as corporate demand for AI development tools continues to surge.

The startup's success hasn't gone unnoticed by industry giants. Earlier this year, Anysphere reportedly turned down acquisition offers from potential buyers including OpenAI - which recently acquired rival AI assistant Windsurf for $3 billion. The decision to remain independent signals confidence in Cursor's market position and future growth potential.

Key Points

- Anysphere reaches $9.9B valuation after raising $900M in latest funding round

- Company reports ARR exceeding $500M with revenue doubling every two months

- Cursor expands from individual to enterprise licensing model

- Startup rejects acquisition offers to pursue independent growth strategy