AI Training Costs Hit $1B as Inference Costs Drop 99%, Report Shows

Prominent tech investor Mary Meeker's latest AI industry report highlights a dramatic split in artificial intelligence economics. While training costs for advanced models approach the billion-dollar mark, inference costs have collapsed by an astonishing 99% due to hardware and algorithmic breakthroughs.

The Billion-Dollar Training Barrier

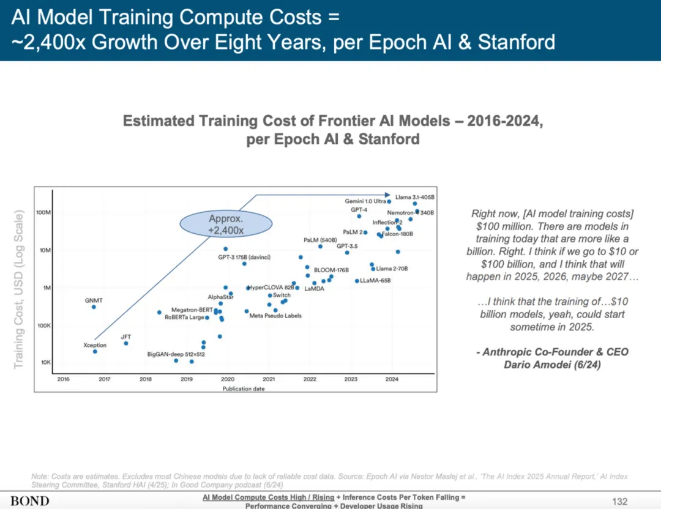

Anthropic CEO Dario Amodei predicts training costs for cutting-edge language models will soon cross the $1 billion threshold. His forecast aligns with data showing a 2,400-fold increase in training expenses since 2016. This exponential growth has created an AI arms race accessible only to tech giants and well-funded startups.

The staggering costs stem from voracious compute demands. Training today's most advanced models requires thousands of high-end GPUs running continuously for months, with hourly operational expenses reaching tens of thousands of dollars. This capital intensity is rapidly consolidating foundational model development among a handful of deep-pocketed players.

The Inference Cost Collapse

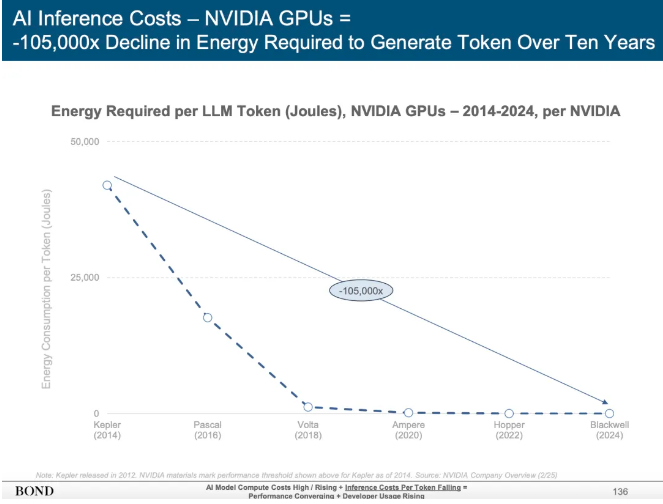

While training becomes prohibitively expensive, running trained models (inference) has become dramatically cheaper. Stanford researchers found inference costs per million tokens dropped 99% in just two years. Nvidia's latest Blackwell GPUs demonstrate this trend - they're 105,000 times more energy efficient than their decade-old predecessors.

This cost revolution enables services like ChatGPT to scale rapidly. When generating responses costs pennies, companies can offer AI services to millions at minimal marginal cost. The plunging inference prices are fueling an explosion of specialized AI applications across industries.

The Profitability Paradox

AI companies now face unprecedented financial pressures. They must spend billions developing models while market forces push service prices toward zero. OpenAI's financials illustrate this tension - its computing expenses grow in lockstep with revenue, leaving little room for profit.

Even tech titans like Microsoft and Amazon see their cash flow margins squeezed by AI investments. Meeker compares today's AI builders to early Amazon and Tesla - companies that burned cash for years to build unassailable market positions.

Network Effects: The Path Forward

The report identifies network effects as the key to sustainable AI profitability. Companies must move beyond technical superiority to build user ecosystems, data advantages, and platform moats. At sufficient scale, declining marginal costs can finally outpace falling prices.

This explains why leaders like OpenAI and Google aggressively court developers. Their platforms become more valuable as more applications are built on them - creating the virtuous cycles that powered previous tech giants.

An Industry Reshaped

The cost divide is restructuring the entire AI sector. Foundational model development concentrates among a few well-funded players while application innovation flourishes across countless startups. Companies caught in the middle - those without either massive resources or niche focus - face existential threats.

The result may be an "hourglass" industry structure: a handful of model providers at the top, armies of app developers at the bottom, and empty space in between. For businesses navigating this transformation, understanding these economic forces will separate survivors from casualties.

Key Points

- AI training costs approach $1 billion while inference costs drop 99%

- Hardware advances make inference dramatically cheaper but training more expensive

- Only companies building network effects will achieve sustainable profits

- The industry is splitting into model providers and application developers

- Middle-tier AI companies risk being squeezed out of the market