2025 AI API Market: Gemini Leads, DeepSeek Surges

2025 AI API Market Analysis: Gemini Dominates as DeepSeek Rises

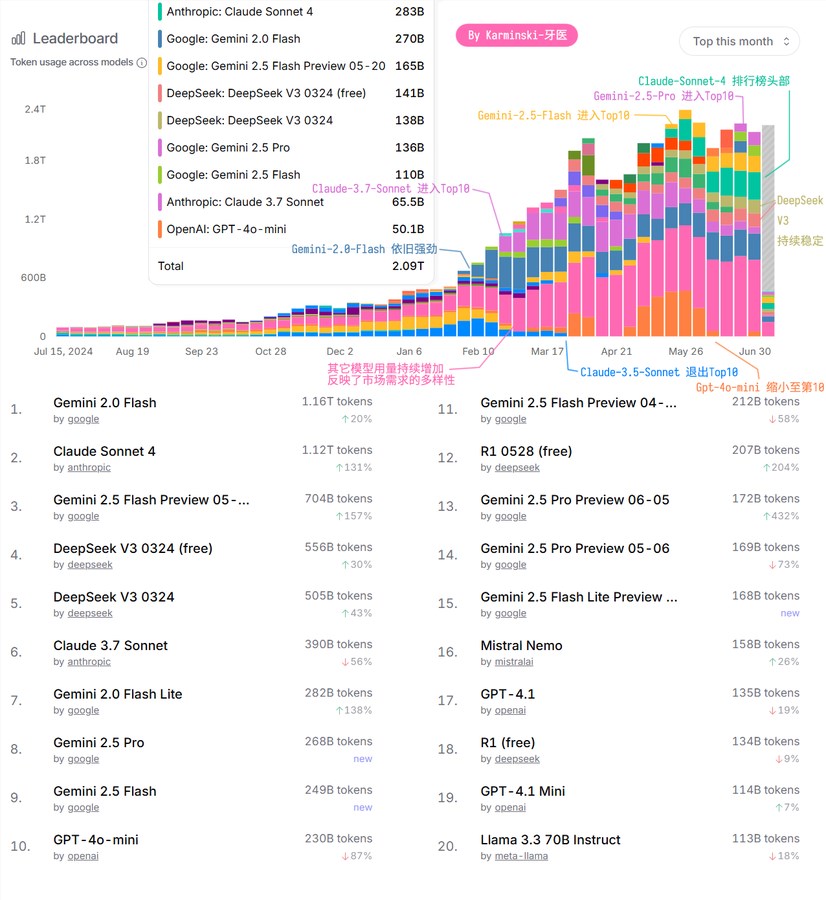

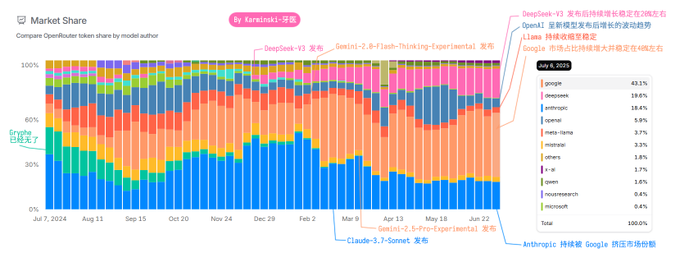

The AI API market has undergone significant shifts in the first half of 2025, with Google's Gemini series maintaining a strong lead while DeepSeek-V3 emerged as a dark horse contender. Data from OpenRouter reveals key trends shaping the competitive landscape.

Market Leaders and Rising Stars

Gemini-2.0-Flash remains the most popular model, offering high cost-effectiveness at just $0.4 per million tokens output. Its successor, Gemini-2.5-Flash-Preview-0520, has climbed to third place, demonstrating Google's strategic pricing advantage.

Image source: karminski - Dentist

The standout performer is DeepSeek-V3, which has consistently ranked in the Top 10 since launch. When combining free and paid version usage, its total volume rivals second-place Claude-Sonnet-4. Developers praise DeepSeek for its strong programming and reasoning capabilities at competitive prices.

Market Stabilization and Niche Growth

After explosive Q1 growth (400% increase in token usage), the market stabilized at around 2 trillion tokens weekly. This indicates maturation from initial hype to sustainable demand:

Image source: karminski - Dentist

- Long-tail models maintain 600-700 billion token usage

- Specialized models gain traction for scenario-specific needs

- Developer preferences show increasing segmentation

Strategic Moves by Major Players

Google's precise pricing strategy with Gemini Flash models has secured market dominance. The upcoming Gemini-2.5-Flash shows potential to replace its predecessor if priced competitively.

Anthropic's Claude series transitioned smoothly but faces pressure:

- Claude-Sonnet-4 maintains stable performance

- Premium models struggle against cost-effective alternatives

The biggest surprise comes from OpenAI, where GPT-4o-mini showed volatile performance despite May's marketing surge, failing to secure a consistent Top 10 position.

Image source: karminski - Dentist

Future Outlook: The Price-Performance Balance

The market is evolving beyond pure capability metrics:

- Price wars intensify: Google leads with aggressive pricing

- Performance optimization: DeepSeek proves open-source can compete

- Ecosystem development: Long-term success requires robust developer support

- Scenario adaptation: Niche applications drive specialized model demand

The "second half" of AI API competition will focus on sustainable ecosystems rather than raw benchmark numbers.

Key Points:

- Gemini maintains lead through cost-effective Flash models

- DeepSeek-V3 emerges as strongest challenger

- Market stabilizes after initial boom period

- OpenAI struggles with inconsistent performance

- Future competition hinges on price-performance balance